$975 billion: ai proptech market in real estate

The global commercial real estate industry handles nearly $4 trillion in transactions1. Yet much of its data — an untapped goldmine — remains underused. According to Morgan Stanley Research, Artificial Intelligence (AI) could unlock $34 billion in efficiency gains by 20302, but most firms are still tied to outdated models that drain profits. Meanwhile, the AI in real estate market is projected to hit $975.24 billion globally by 20293.

For C-suite leaders, the stakes are high. Rising costs, stricter environmental rules, and sharper competition demand change. The choice is simple: leverage AI to drive transformation—or risk being disrupted by it.

What Are The Top Three Roadblocks Crippling Real Estate Operations?

1. The Technology Infrastructure Trap

Real estate enterprises generate enormous volumes of valuable data daily, but this information remains fragmented across disparate systems. Property management software, tenant communications, financial records scattered across local servers – this technological fragmentation leads to data fragmentation – costing the business complete real estate data analytics. The data sits in silos, rather than being strategically used for decision making.

The Real Cost: Without a single source of truth, teams spend countless hours aggregating information for basic reporting and can’t perform strategic analysis. This inefficiency directly impacts sales, operational margins and profit while limiting the ability to make data-driven decisions that could optimize every square foot of the portfolio.

2. When Culture Resists AI

Leadership teams recognize AI’s potential and express enthusiasm for Proptech advancement. Yet, lack of cultural buy-in stalls implementations at the operational level.

Salespeople, property managers, brokers, leasing agents, and facilities teams often resist adopting AI, defaulting to familiar processes even when they’re demonstrably inefficient.

AI adoption in most real estate organizations remains superficial – often limited to using ChatGPT for property descriptions or social media content. This shallow implementation fails to address the fundamental operational challenges that impact the bottom line.

The Hidden Impact of Cultural Resistance to AI: A 2024 survey found that nearly 60% of business owners in real estate are still working on legacy systems, which might not be adaptable to new technologies4. This resistance creates a cascade effect where the organization falls further behind competitors who successfully integrate AI into their core operations.

3. The Real Estate Dilemma: Combine Instincts with Real Estate Data Analytics

An expert’s industry expertise and market intuition are invaluable; no algorithm can replace decades of real estate experience. However, relying solely on gut instinct in today’s data-rich environment is like driving a Ferrari in first gear. We have the power but aren’t accessing it.

The Missed Revenue Opportunity: When we combine our team’s market experience with sophisticated real estate data analytics and AI, we unlock the ability to:

- Launch laser-targeted marketing campaigns that deliver measurably higher ROI.

- Optimize revenue per square foot through predictive occupancy modeling, etc.

- Reduce utility costs and improve sustainability with intelligent building management systems.

- Ensure regulatory compliance before issues arise.

Without AI to process and analyze data, these insights can each require weeks or months of manual analysis, if pursued at all. This delay transforms potential competitive advantages into missed opportunities.

From Data to Dollars: The ROI Reality

An AI and Data system shouldn’t just store the data but actively work to increase profitability. Consider these real-world examples:

Revenue Optimization: AI analysis of historical occupancy patterns, future market trends, and tenant behavior identifies the optimal pricing strategy for each property, potentially increasing revenue by 15-25% without additional marketing spend.

Intelligent Sales: AI guided sales involve the use of AI to find the right prospects, to help the sales and brokerage team through the process of approaching the prospect in the right way, and ensuring they are coached through the entire process till closing the sales and beyond. This creates positive outcomes for the end customer while maximizing profits for the business.

Cost Reduction: Predictive maintenance powered by IoT sensors and AI analysis reduces facilities management costs by 20-30% while extending asset lifecycles and preventing costly emergency repairs.

Sustainable Development: Data from the past and Machine Learning predictions about the future are key to planning and ensuring adoption of the right strategies to reduce carbon emissions and stay compliant to sustainable development goals.

Risk Management: The role of AI in Real Estate Investing is quite significant. AI-driven analysis of market conditions, tenant creditworthiness, and property performance helps avoid problematic investments and optimize the portfolio allocation, potentially saving millions in avoided losses.

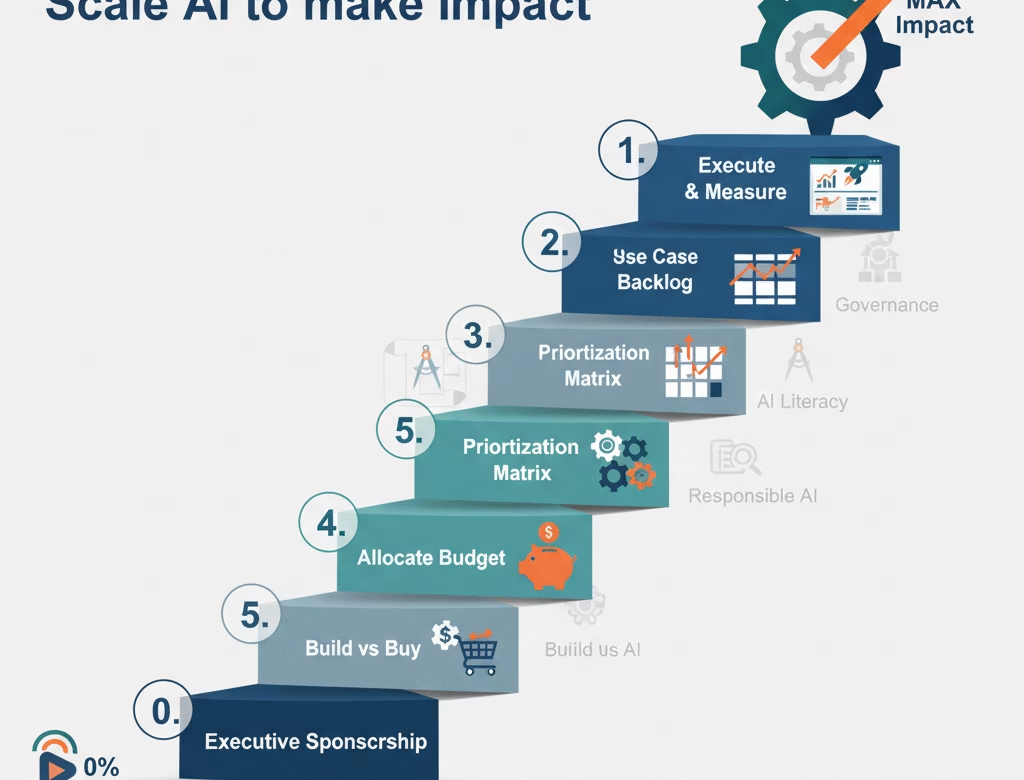

The Strategic Implementation Framework

Successful AI implementation in real estate requires a systematic approach that addresses your current infrastructure while building toward transformational capabilities:

Phase 1: Data Assessment and Migration

The foundation of any successful AI implementation requires understanding the current data landscape with a view to solving the business problems. Where is the data generated, and stored – and how does it solve the specific real-estate business problem? How is it formatted and processed? What’s the quality and completeness of the information? This assessment phase identifies routes to quick wins while establishing the infrastructure for more sophisticated applications.

Phase 2: Cloud Integration and System Unification

While it is possible to work in a non-Cloud environment, we are big believers in the power of the Cloud for maximizing the impact of Data and AI. A proper Data and AI implementation creates an analytical data system where information flows seamlessly between departments and systems to solve the business problems identified. This integration provides immediate benefits of a single source of truth – resulting in team collaboration and data accessibility while setting the stage for AI deployment.

Phase 3: AI (and Agent) Implementation

This is where gradual transformation occurs. Impact (built responsibly) generates positive outcomes with deployment of data and AI models, and with LLMs used properly.

Not everything needs AI Agents, and decisions need to be taken to build and deploy the right AI and Data solutions. When used properly, AI agents can analyze data, actively monitor operations, identify opportunities, recommend and execute actions aligned with business objectives. Whether optimizing lease renewals, predicting maintenance needs, or identifying expansion opportunities, AI agents work continuously to improve the bottom line.

Act Today, Stay Ahead Tomorrow

Every part of the Real Estate industry can be optimized with AI and Data technologies – whether commercial or residential. From Sales to Operations, data is being generated, and AI can be used to create a sustainable competitive edge, when acted on methodically.

From Vision to Value

Real Estate companies don’t need to build AI solutions from scratch.

At Data-Hat AI, we build accelerators and deploy them to get impact faster – we specialize in working with real estate enterprises across the United States, United Kingdom, and Middle East to implement responsible AI solutions that deliver measurable results.

Our approach combines deep real estate industry knowledge with cutting-edge AI technology, ensuring solutions that address specific operational challenges while delivering the ROI stakeholder’s demand.

Organizations today sit on a goldmine of data. The AI tools to unlock that value already exist. The real opportunity is for leaders to seize this competitive advantage—transforming operations, strengthening margins, and setting the pace for the industry.

Ready to transform your real estate operations with AI? Contact Data-Hat A at info@data-hat.com to schedule your free strategic data and AI assessment and discover the hidden value within your organization.

Real Estate AI Implementation: Key Questions & Answers

Question 1: How can AI platforms unify fragmented data from property management systems across a multi-state commercial portfolio?

AI platforms address the critical data fragmentation problem by creating a unified cloud-based data warehouses that automatically collect information from disparate property management systems. AI agents work autonomously to continuously gather data from multiple sources, validate its accuracy, and store it systematically in a centralized location. This cloud integration transforms scattered local data into a cohesive, accessible system that enables real-time decision-making across entire portfolios, eliminating the operational inefficiencies that currently plague most real estate enterprises.

Question 2: What is the measurable ROI of implementing AI for predictive maintenance, cost reduction, and operational efficiency in large commercial portfolios?

AI-driven predictive maintenance delivers substantial measurable returns, typically achieving 10-40% reductions in maintenance costs and 30-50% fewer equipment failures5. Industry studies demonstrate payback periods of under one year with 3-year ROIs exceeding 300%6. Best-case deployments have achieved over 100% annual ROI and even 10× returns when properly integrated. When combined with smart building controls, these systems also generate significant energy savings, making predictive maintenance one of the most financially compelling AI applications for property management across offices, mixed-use, and retail portfolios.

Question 3: What are the best AI solutions to optimize revenue per square foot and boost tenant retention across different real estate sectors?

Revenue optimization through AI requires customized solutions that address dynamic pricing strategies, occupancy maximization, optimal tenant mix planning, and vacancy reduction. AI systems analyze market conditions, tenant behavior patterns, and property performance data to recommend pricing adjustments and identify value-adding amenities that increase foot traffic and tenant satisfaction. Since real estate markets vary significantly by region and property type, successful implementations require tailored approaches that combine predictive analytics with local market intelligence to maximize net operating income while reducing tenant turnover costs.

Question 4: How can executives overcome cultural resistance and successfully adopt AI within real estate firms at scale?

Successful AI adoption requires a dual-pronged approach combining top-down leadership commitment with grassroots implementation. Senior executives must drive the cultural transformation while simultaneously building support at the operational level through consistent, methodical change management over an extended period. This systematic approach often necessitates strategic changes in talent acquisition and leadership development to build AI literacy throughout the organization.

Question 5: How can AI-driven risk management tools help assess investments and ensure compliance for safer portfolio decisions?

AI risk management systems connect to both internal property databases and external market data sources to provide comprehensive investment analysis. These tools analyze rental revenue potential, property value trends, neighborhood dynamics, regulatory requirements, and tenant churn patterns to generate data-driven investment recommendations. By processing multiple data relationships simultaneously, AI agents can identify potential risks and opportunities that traditional analysis might miss, enabling more informed portfolio decisions while ensuring compliance with evolving local and environmental regulations.

Question 6: How can AI and IoT solutions help achieve carbon emission reduction and sustainability goals in global real estate markets?

IoT sensors combined with AI analytics create intelligent building management systems that optimize energy usage based on real-time occupancy patterns and equipment performance data. AI agents analyze foot traffic, tenant movement, and utility consumption to automatically adjust building systems during high and low usage periods. Through predictive maintenance capabilities, these systems ensure equipment operates at peak efficiency while extending asset lifecycles. AI innovations could lead to $34 billion in efficiency gains for the real estate industry by 20303, with significant portions coming from sustainability improvements and reduced operational waste.

Question 7: How can AI agents automate lease renewals and pricing optimization to reduce costs for property managers?

AI agents streamline property management workflows by automating lease renewal notifications, analyzing foot traffic and area performance to recommend optimal rental rates, and suggesting alternative locations based on tenant requirements. These systems leverage comprehensive portfolio data to match tenant needs with available spaces while scheduling maintenance calls to minimize operational disruptions. By processing data across all managed properties simultaneously, AI agents can identify opportunities for cross-portfolio optimization and proactive tenant relationship management that reduces vacancy periods and maximizes revenue per unit.

Question 8: How can AI-driven sales intelligence identify high-value prospects in competitive luxury and mixed-use markets?

AI sales intelligence systems create hyper-personalized prospect profiles by combining lead source information with historical data from existing proptech systems. These platforms identify high-value leads and international investors by analyzing behavioral patterns, investment capacity, and market preferences. Beyond prospect identification, AI agents generate customized marketing materials and comprehensive knowledge bases that equip brokers and agents with targeted information for each prospect, significantly improving deal closure rates in competitive luxury and mixed-use real estate markets.

Question 9: What cloud-based AI frameworks should real estate enterprises adopt for scalability and future growth?

Real estate enterprises should implement cloud-based AI frameworks that create unified data layers while integrating seamlessly with existing legacy systems. These frameworks enable real-time data access, advanced analytics, and automation across multi-property portfolios while supporting predictive maintenance, dynamic pricing, and enhanced tenant experiences. Cloud architecture ensures scalability without costly IT overhauls, allowing AI models to continuously learn from market and tenant data to drive efficiency and revenue growth.

Source:

- https://www.globenewswire.com/news-release/2022/05/03/2434810/0/en/Global-4-Trillion-Real-Estate-Market-is-Expected-to-Grow-at-a-CAGR-of-over-4-9-During-2022-2028-Vantage-Market-Research.html

- https://www.morganstanley.com/insights/articles/ai-in-real-estate-2025

- https://www.thebusinessresearchcompany.com/report/ai-in-real-estate-global-market-report

- https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/commercial-real-estate-outlook-2024.html

- https://www.provalet.io/guides-posts/predictive-maintenance-case-studies

- https://www.jll.com/en-us/insights/artificial-intelligence-and-its-implications-for-real-estate